Executive Chairman and Representative Director

David Semaya is Executive Chairman and Representative Director of SUMITOMO MITSUI TRUST ASSET MANAGEMENT Co., Ltd. Japan’s largest asset manager with approximately $650 billion in assets under management. David also serves as an Advisor to Sumitomo Mitsui Trust Group, Inc. His thirty-seven year career spans three continents in executive leadership roles in financial services across the US, Europe, and Asia. Now based in Tokyo, he joined SuMiTrust Asset Management in April 2018. Previously, David served as Executive Chairman of Nikko Asset Management both in London and Tokyo. Prior to returning to Japan, he led UK and Ireland Wealth Management for Barclays PLC, and was Chairman of Barclays Asset Management Ltd. Prior to this, David was CEO for Barclays Global Investors (now Blackrock) Europe and Asia, he also was CEO of the Japan business. Until 2004, David was with Merrill Lynch and Co. in a variety of executive leadership positions in both Asset Management and Investment Banking in New York and Tokyo. David currently serves as Chairman of the Investment Company Institute Global APAC Steering Council and as an Ambassador for FinCity Tokyo. He formerly served on the board of the Investment Association in the UK and was a pension fund trustee director for two UK pension funds. David currently serves on the oversight board of Temple University Japan, as Counsellor for the Japan Center for International Exchange, and as Commissioner and Treasurer of the Japan-U.S. Educational Commission (Fulbright program). David holds a BA in Political Science from The University of Florida, a Masters in Education from Temple University and has completed the Stanford/NUS Executive Program in International Management. David is a dual US/UK National and is fluent in the Japanese language.

The PRI is a UN-supported organisation, with more than 5,000 signatories who collectively represent over US $128 trillion in AUM. He is responsible for the PRI’s global operations. David previously served as the Deputy CEO for AMP Capital and prior to that spent almost 13 years as the CEO for Cbus Superannuation Fund, where he saw membership grow from 500,000 to over 750,000 and AUM rise to AUD $55 billion. David has received the Distinguished Alumni Award from La Trobe University for his work in the sustainable finance field, was awarded the Fund Executives Association Ltd (FEAL) Fund Executive of the Year in 2017 and was presented with an Association of Superannuation Funds of Australia (ASFA) Life Membership in 2020.

Strategy Development and Management Bureau,

Financial Services Agency of Japan

Mr. Yoshio Horimoto has been Vice Commissioner for Strategy Development and Evidence-based Policymaking, Strategy Development and Management Bureau, Financial Services Agency of Japan (JFSA) since June 2022. Mr.

Horimoto is responsible for planning the overall financial policies of JFSA, promoting sustainable finance, and strengthening functions as the international financial center of Japan.

Mr. Horimoto started his career at the Ministry of Finance, as well as serving as a Special Advisor for the International Bank for Reconstruction and Development (IBRD).

Throughout his career at JFSA, Mr. Horimoto has mainly been involved in the supervision and inspection of financial institutions. Mr. Horimoto was Deputy Director-General, Supervision Bureau, in charge of the supervision of Mega Banks among other large financial institutions from 2021 to June 2022, preceded by being Deputy Director-General, Strategy Development and Management Bureau, in charge of the inspection from 2019 to June 2021.

Mr. Horimoto has also been Counsellor of Cabinet Secretariat and Deputy Director-General of Cabinet Secretariat since 2014. Mr. Horimoto is currently Deputy Director-General of the New Form of Capitalism Realization Headquarters, Cabinet Secretariat.

Additionally, Mr. Horimoto worked as a senior manager at a private consulting firm for five years.

Mr. Horimoto holds B.B.A. from the University of Tokyo.

Mr. Takada has been working as a government official for the Ministry of Finance (MOF) since 1995. He has had a wide range of experience in policy-making at the heart of the government including public finance, tax, trade policies and financial services. During over 20 years of his career he spent 5 years in the UK: study at Cambridge and LSE (1997-99), and secondment to HM Treasury (the UK finance ministry, 2003-06) where he worked on financial regulation, investment market policies and public spending.

In 2009, Mr. Takada became the first staff of the newly created National Policy Unit and worked in the Prime Minister’s Office and the Cabinet Secretariat as an architect of the new public finance framework and as a private advisor to the Prime Minister. After having held senior positions in the Finance Minister’s Secretariat responsible for policy coordination and public relations of the Ministry, he was seconded to the OECD, Paris, where he served as a Senior Policy Analyst at the Green Finance and Investment team, Environment Directorate, from 2015 to 2018.

After his return to Tokyo in 2018, Mr. Takada worked at several offices in the MOF and other parts of the government including the Climate Change Office at the Cabinet Secretariat (2021). From 2022, Mr. Takada served as the Director for Strategy Development at the Financial Services Agency, responsible for financial market policies including promotion of international financial centres and sustainable finance. From July 2024, Mr. Takada has been seconded to the GX (Green Transformation) Acceleration Agency as its Director. The GX Acceleration Agency is newly launched by the Japanese Government to accelerate decarbonisation and green transformation in Japan and beyond. Alongside his official jobs, in his private capacity, Mr. Takada launched the Green Finance Network Japan (GFNJ) in 2018 as its Secretary General. The GFNJ is an informal network that brings together key players on green finance in Japan from both public and private sectors and provides a platform for collaborating with international stakeholders. Mr. Takada received a Bachelor degree in Law (University of Tokyo), a Master degree in Law (Cambridge University) and an MBA (Imperial College London).

Tatsuro Watanabe is an Executive Officer and Chief Sustainability Officer for Mitsui O.S.K. Lines, Ltd. (MOL) since April 2023. He is responsible for the Corporate Marketing Division and Environment & Sustainability Strategy Division.

He joined MOL in 1992 and established his career mainly in the LNG and energy business sectors. In 1999 he was transferred to Doha as a Doha Representative for 5 years. Over these years, he acted as the commercial contact point for customers in the Middle East, as well as being in charge of new LNG business development and contact management.

After returning to Tokyo and gaining experience in a managerial position in the Energy Business Strategy Division in MOL Tokyo, in 2020 he was appointed as Managing Director of MOL (Europe Africa) Ltd., which is based in London. He managed and led MOL’s overall Europe and Africa business as the regional head.

In 2023, he returned to Tokyo and was newly appointed as an Executive Officer and Chief Sustainability Officer, a key role in leading the company’s overall environmental strategy.

He graduated from the School of Law, Waseda University, in March 1992.

Mami Negishi is a seasoned bond specialist with Daiwa Securities, having joined the company in 2004. She has over 20 years of experience, advising on bond issuances and excelling in her role with her profound securities knowledge. She has international investment banking experience in Singapore and Vietnam. Currently, since April 2023, she holds a pivotal position in the firm, promoting sustainability finance of bond and equity products. Mami earned a Master's in International Public Policy from Osaka University, strengthening her ability to comprehend and shape public policy in global finance. Her practical experience and academic insight establish her as a field leader.

Societe Generale Securities Japan Limited

Branch Manager, Group Country Head, Japan

Societe Generale, Tokyo Branch

Bruno joined Societe Generale in 2010 as Market Risk Assessor.

In 2012 Bruno became Co-Head (until 2015) and then Head of Risk on Capital Market activities.

In September 2021, Bruno was appointed as Representative Director and Group Country Head of Societe General Securities Japan Limited and he was appointed as Branch Manager and Group Country Head of Societe General, Tokyo Branch in December.

Before joining Societe Generale, Bruno was Global Head of Market Risk for Natixis, Global Risk Manager for Gaselys (Gazde France), and held several senior positions in market risk on

Capital Market activities in Paris and London for Credit Lyonnais and Credit Agricole.

After graduating from Keio University, joined Rakuten, Inc. Recognized with a company award for his outstanding performance in sales, he then transitioned to the New Service Development Department. There, he spearheaded the launch of several new businesses and gained experience in investing in domestic and international startups, with one of them eventually going public. He established a drone business and participated as a researcher in the NEDO project. With the aim of constructing a drone air traffic control system in Japan, he co-founded a joint venture with an overseas startup and assumed the role of Chief Strategy Officer. In 2018, he moved to Apple Japan, where he was responsible for Apple Pay's online business in Japan and South Korea, as well as the transportation business. He played a pivotal role in launching the service in South Korea and promoting the integration of Apple Pay with large-scale transportation infrastructure projects. He currently serves as the Chief Operating Officer of Carbon EX Inc.

Managing Director, South Pole Japan

Since the founding of South Pole in 2006, Patrick has been an influencer and innovator in carbon markets and corporate sustainability. Starting out as Chief Technical Officer for the company, he led the implementation and quality control of the entire project portfolio, supervising more than 200 climate change mitigation projects in 25 countries, and played a keyrole in the evolution of carbon markets and standards. Patrick then extended his expertise to help launch South Pole’s advisory business, which has enabled thousands of corporate organisations around the world to take climate action towards net zero, as well as played a leading role in South Pole’s work with the public sector and impact funds.

In September 2022, Patrick relocated to Tokyo to lead the establishment of South Pole’s presence in Japan.

Patrick holds a M.Sc. in mechanical engineering from the Swiss Federal Institute of Technology in Zurich.

Tommy Ricketts is the CEO and co-founder of BeZero Carbon, a global ratings agency for carbon markets. BeZero Carbon was founded in 2020 and its global team combines expertise in climate and earth science, financial research, data science, and public policy to provide reliable and qualified assessments on the quality of carbon credits. Prior to starting BeZero Carbon, he was a Vice President in Global Research at the Bank of America and had also worked as a political strategist in London and Brussels.

IFRS Foundation

Hiroshi Komori was appointed as a member of the International Sustainability Standards Board (ISSB) in August 2022, effective 1 September 2022.

Before joining the ISSB, Mr Komori served as Senior Director and Head of the Stewardship of the ESG Division at the Government Pension Investment Fund (GPIF) in Japan from 2015 to 2022, where he established the Division and developed GPIF’s investor engagement and participation in international sustainability initiatives.

Prior to his work at GPIF, he worked for Sumitomo Mitsui Trust Bank, where he created an investor relations consulting service for Japanese companies and Saitama Bank (now Resona Bank). Mr Komori holds a Master’s degree of International Relations from the International University of Japan.

Co-founder and Co-President, U3 Innovations,LLC

Ph.D. in Engineering (The University of Tokyo)

Ms Takeuchi graduated from Keio University’s Faculty of Law and joined TEPCO in 1994.

She had been engaged in Oze National Park nature preservation for over 10 years and was involved in international negotiations of United Nations Framework Convention on Climate Change.

After leaving TEPCO at the end of 2011, she became an independent researcher on energy and environmental policy. She received her PhD in March 2022 from the University of Tokyo's Graduate School of Engineering. She works for several thinktanks and universities and served on government committees including the GX (Green Transformation) Implementation Council chaired by Prime Minister Kishida, the Council for a Strategy for Hydrogen and Fuel Cells, and the Strategic Commission for the New Automotive Era, Global Environment Subcommittee ,where she has presented a wide range of proposals on energy policy.

Ms Takeuchi founded U3 Innovations LLP in October 2018 and continues to pursue initiatives as President to connect a broad range of industries and companies to ensure that Japan has an abundant supply of sustainable energy by 2050.

She wrote many books such as “20 Tips for Protecting Everyone‘s Nature”, “The truth of energy policies", “Is the nuclear power plant ”safe“? –A report on the Fukushima nuclear accident written by one single researcher”, "Energy industries in 2050 – The game change to Utility 3.0", “Energy Industries’ Strategy toward 2030 -Implementing Utility 3.0 (Nihon Keizai Shimbun Publishing)”.The latest was published at the end of 2022 , “Energy Policy Collapse - The Energy Defeat of a Nation without Strategy”.

Head of the Technology & Engineering Division, in charge of the Central Research Institute, Iwatani Hydrogen Technology Institute, and Sustainability Promotion Department, Safety Supervisor, Hydrogen Energy Supervisor

April 1987: Joined the Ministry of International Trade and Industry

July 2008: Director of the Chemical Management Division, Manufacturing Industries Bureau, Ministry of Economy, Trade and Industry (METI)

July 2010: Director of the Research and Development Division, Industrial Science and Technology Policy and Environment Bureau

July 2012: Director of the Healthcare Industries Division, Commerce and Information Policy Bureau

July 2015: Deputy Director-General, Manufacturing Industries Bureau

June 2016: Deputy Director-General, Commerce, Distribution, and Safety Group (in charge of Industrial Safety)

July 2017:Director-General for Technology Policy Coordination and Industrial and Product Safety, Minister's Secretariat

July 2019: Retired from METI

November 2019: Joined Iwatani Corporation; appointed Senior Executive Officer in charge of Environment and Safety

April 2020: Appointed Senior Executive Officer; responsible for the Comprehensive Energy Division and the Industrial Gas Division, in charge of Environment and Safety, and Hydrogen Energy

April 2021: Responsible for the Comprehensive Energy Division and the Industrial Gas Division, in charge of Environment and Safety, and Hydrogen Energy

April 2022: Appointed Head of the Technology & Engineering Division, in charge of the Central Research Institute, Iwatani Hydrogen Technology Institute, Environment and Safety, and Hydrogen Energy

June 2022: Appointed Director and Senior Executive Officer (current position)

April 2023: Head of the Technology & Engineering Division, in charge of the Central Research Institute, Iwatani Hydrogen Technology Institute, Sustainability Promotion Department, Safety Supervisor, and Hydrogen Energy Supervisor (current position)

Hideaki Tanaka is currently Operating Officer, General Manager, Hydrogen Business Department in ENEOS Corporation. His responsibility is to conduct priority measures as follows to develop hydrogen supply chain in Japan with stability and large scale leveraging ENEOS’s existing refinery assets:

・ Cooperate with overseas countries where CO2-free hydrogen is abundant to establish stable hydrogen supply to Japan.

・Develop supply route to power plants and steel mills from the refineries to generate hydrogen demand with large scale.

・Develop hydrogen incorporated energy platform that enables local production for local consumption to pursue synergy with multiple kinds of renewable energy.

・ Develop FCV network targeting commercial vehicles in addition to private vehicles in order to establish scale economy for the hydrogen gas station business.

Hideaki Tanaka received the B.E. and M.E. degree in Chemical Engineering from The University of Tokyo in 1989 and 1991, respectively, and received MBA degree from Amos Tuck School of Business in 1999.

He joined Toa Nenryo Kogyo in 1991. His former positions in ENEOS are General Manager of Manufacturing Project Department, Refinery Manager of Osaka Refinery and General Manager of Mechanical Engineering Department. He has experience working for ExxonMobil R&S (Fairfax) in 2004-2007 as Asia Pacific Advisor, Supply Chain Optimization, Global Logistics Optimization, seconded from TonenGeneral Corporation as expatriate.

Partner / Head of Renewables and Sustainability

Joined Advantage Partners in July 2021 and in charge of the fourth investment strategy, which is newly launched with the aim of not only increasing corporate value but also creating social and environmental value. Will provide financial support towards a carbon-free society.

Joined Mitsubishi Corporation in 1992, involved in Japanese real estate development, buyout investment in the US, Japan, and Europe, and investment in power development (IPP) centered on renewable energy in Europe and the Middle East. Served as department head and president of the local subsidiary. Spent 14 years overseas.

B.E. in urban engineering from the University of Tokyo, and an MBA from the MIT Sloan School of Management.

Licensed First-class Architect.

Sayuri Shirai is a Professor at Keio University's Faculty of Policy Management. She also serves as an Advisor on Sustainable Policies at the Asian Development Bank Institute, overseeing the ADBI-ADB Climate Finance Dialogue, a pivotal initiative to promote information exchange and understanding about climate-related disclosure and related financial policies among financial supervisors and central banks in Asia. Previously, Sayuri held a senior advisory role at EOS, part of Federated Hermes in London, from 2020 to 2021, where she played a vital role in providing ESG stewardship services to listed companies worldwide. Her extensive experience also includes serving as a Member of the Policy Board of the Bank of Japan (BOJ) from 2011 to 2016. Prior to that, she taught at Sciences Po in Paris and worked as an economist at the IMF. Sayuri holds a Ph.D. in Economics from Columbia University. She is an author, with numerous published books and papers. Her latest book, titled "Environment and Business," was published in Japanese in July 2024. For further information, please visit her official homepage: http://www.sayurishirai.jp/

Dr. Kaneko was born in Hokkaido in 1980. He received his B.S. degree in engineering from Nagoya University, Japan, in 2003, and his M.S. degree in engineering from the same university in 2005. He obtained his Ph.D. degree in electronics and applied physics from the Tokyo Institute of Technology, Japan, in 2012.

In 2005, he joined Matsushita Electric Industrial Co., Ltd. (now Panasonic Holdings Corporation), where he has been engaged in the development of materials and devices. In 2015, he was assigned as an on-site manager at imec in Belgium. After returning to Japan in 2019, he took on the role of manager of the Perovskite PV team. He has held his current position since 2021.

Shunsuke Kawashima commenced his career at ITOCHU Corporation in 1999, where he has been actively engaged in the energy sector, with a primary emphasis on the procurement of chemical raw materials within the Energy and Chemicals Division. Following a six-year tenure in Singapore beginning in 2008, he undertook various pivotal roles within the planning and project promotion teams of the Energy and Chemicals Division. Subsequently, at ITOCHU's headquarters, he served as a principal strategist within the Corporate Planning & Administration Division, providing critical support to top management. Since 2023, Mr. Kawashima has been at the helm of the Energy Storage System (ESS) business, overseeing all categories from residential to industrial and grid storage solutions.

(Online)

Based in Singapore, Roger joined DBS in 2022 as one of the team leads in IBG Sustainability covering various sectors. In his current role, he leads in delivering technical environmental and social expertise to business transactions and client advisory globally, ensuring project financing adheres to international standards on sustainability and best practice.

Roger has over 25 years of experience mainly in the energy sector. His areas of expertise include technical environmental and safety engineering, operational excellence, risk management and corporate sustainability strategy implementation.

As an independent non-executive Director to a Singapore-based cleantech startup, Roger advises on both technical and sustainability matters related to Lithium-Ion Battery recycling technologies. For complete bio, please visit http://linkedin.com/in/rcharlesuk

Development Bank of Japan, Inc.

Fumiyo Harada serves as Managing Executive Officer of the Development Bank of Japan, Inc. (DBJ). Prior to this appointment she was an Executive Officer of DBJ with particular responsibility for the GRIT Strategy (Green, Resilience & Recovery, Innovation, and Transition/Transformation), a core initiative of the bank’s Fifth Medium-term Management Plan. While Executive Officer she concurrently served as General Manager of the Corporate Planning & Coordination Department and Chief Manager of the Sustainability Management Office.

Ms.Harada has a long and dynamic career in development banking, including cross-border corporate and infrastructure finance in energy, transportation, and PPP/PFI projects worldwide, with a special focus on the renewable energy sector. She has also been involved in Japanese government policy-making for energy by sitting on several key government committees as a specialist in infrastructure and energy finance. Focusing on areas include power cost, offshore wind power, battery and hydrogen.

She previously led DBJ’s Structured Finance Department and was a Deputy CEO of DBJ Singapore Ltd., a DBJ subsidiary covering corporate and structured finance deals in Southeast Asia and the Pacific. Her experience also includes a secondment to the Infrastructure and Natural Resource Department (East Asia) of the International Finance Corporation (IFC) of the World Bank as a Senior Investment Officer.

July 2024 Re-elected to a third term as Governor of Tokyo

July 2020 Re-elected to a second term as Governor of Tokyo

July 2016 Elected Governor of Tokyo

October 2011 Director, Committee on Budget, House of Representatives

September 2010 Chairperson, General Council, Liberal Democratic Party

July 2007 Minister of Defense

September 2006 Special Advisor to the Prime Minister for National Security Affairs

September 2004 Minister of the Environment and Minister of State for Okinawa and Northern Territories Affairs

September 2003 Minister of the Environment

July 1993 Member of the House of Representatives

July 1992 Member of the House of Councillors

Hiroshi Nakaso was appointed FCT’s first Chairman at its inception in April 2019. He is known widely both locally and globally as the former Deputy Governor of the Bank of Japan (BOJ) which he served for nearly 40 years. At BOJ he was mainly responsible for crisis management of financial systems and markets, often in concert with his overseas counterparts.

In addition to his present role as Chairman of Daiwa Institute of Research (DIR), he is one of the ABAC (APEC Business Advisory Council) members representing Japan, Chairman of the Policy Evaluation Committee of Financial Services Agency of Japan (FSA) and Chairman of the Monitoring Committee for the newly created JPY10 trillion university endowment fund. He also chaired the expert panel for the creation of “Global Financial City: Vision 2.0” for the Tokyo Metropolitan Government.

To be announced

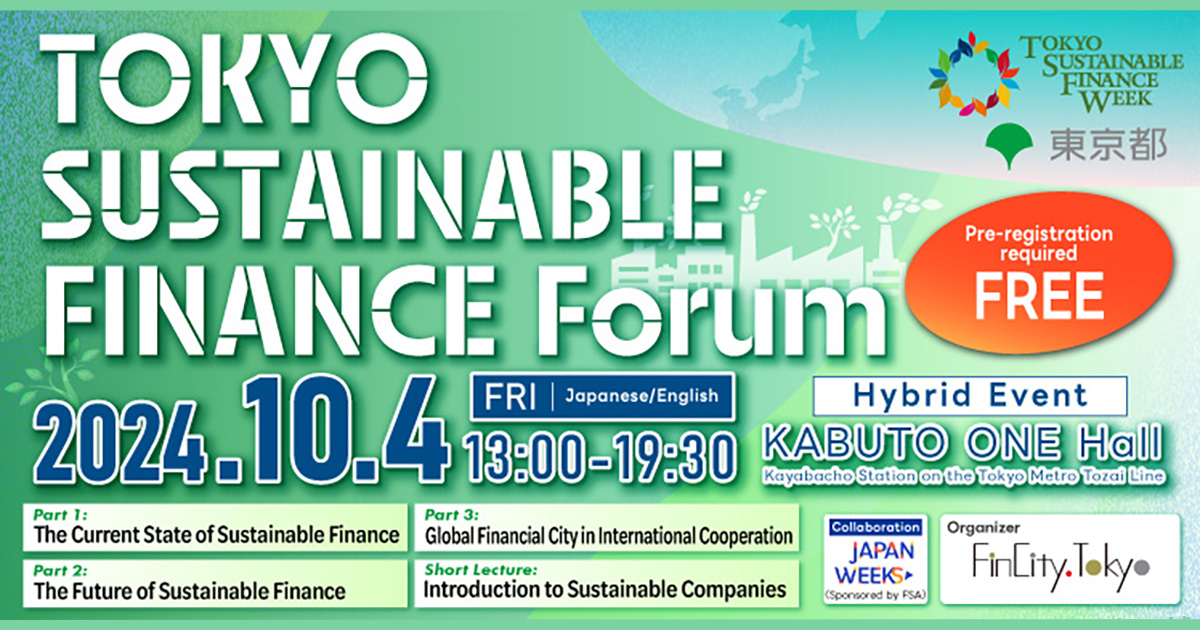

| Organizer | The Organization of Global Financial City Tokyo ※This event is being held as a subsidized project by the Tokyo Metropolitan Government. |

|---|---|

| Supporting Organizations | Principles for Responsible Investment (PRI)/ Financial Services Agency/ Japan Financial Literacy and Education Corporation/ Japan Investment Asset Managers Association(JIAM)/ Japanese Bankers Association/ Investment Trusts Association/ The Japan Association for Financial Planners/ CFA Society Japan/ Japan Investment Advisers Association/ Japan Exchange Group, Inc./ The Securities Analysts Association of Japan/ Japan Securities Dealers Association/ The Alternative Investment Management Association (AIMA) |

| Date & Time | Friday, October 4, 2024, 13:00-19:30 (JST) ※A networking session will be held after the forum at the venue. |

| Format | Hybrid Event (In-Person / Online Participation) ※In-person participation is on a first-come, first-served basis. ※Online participation registration is open until the event ends. ※Simultaneous interpretation in Japanese and English will be provided. |

| Participation fee | Free for both in-person and online participation (pre-registration required) |

| Venue | KABUTO ONE Hall & Conference (7-1 Nihonbashi Kabutocho, Chuo-ku, Tokyo) |

| Access to the Venue | Venue Website: https://kabutoone.tokyo/#access |