This forum is aimed towards stakeholders of domestic and international financial institutions, etc., and will address subjects pertaining to global trends and future outlook of sustainable finance.

“Transition Finance” “Impact Investment” “International Financial City: Tokyo”

Sustainable finance, which uses financial techniques to solve social issues and build a sustainable society, has become a global trend. This forum will focus on three major themes, and through lectures and pitches, we will provide the latest information on sustainable finance, its future prospects and what significance sustainable finance has for the outlook of Tokyo and Japan.

Collaboration with global event “PRI in Person” and “Japan Weeks” organized by the Japanese government

This year, “PRI in Person,” a global event on responsible investment and ESG investment organized by Principles for Responsible Investment (PRI) *1, will be held in Tokyo. This forum will collaborate with PRI in Person, and together we will build momentum for sustainable finance. PRI Chief Executive Officer David Atkin and Chief Sustainable Systems Officer Nathan Fabian will take the stage as speakers at the forum to help deepen discussions.

Participation by companies receiving support under the Tokyo metropolitan government’s initiative of attracting overseas firms, and pitches by domestic startups

In April 2023, the Tokyo metropolitan government established an office with functions of promoting the international financial city concept, attracting overseas companies and advancing regulatory reform. The office puts together core departments related to startups. Mr. Ian Sim, CEO of Impax Asset Management, a leading ESG asset management company in the U.K. that is receiving support from the Tokyo metropolitan government under its initiative of attracting overseas companies, will be speaking at the event.

The Tokyo Financial Awards are given annually to financial businesses that develop and provide innovative financial products and services that contribute to solving the needs of Tokyo residents, and to financial businesses that promote ESG investment. Pitches by companies selected for the Financial Innovation Category and the ESG Investment Category of the awards will be held.

A Belgian citizen, Depus began his banking career in 1987 at The Chase Manhattan Bank in Luxembourg before moving to Tokyo in 1988 and London in 1995.

He joined BankBoston in Singapore in 1997 and returned to Japan to join Societe Generale in 2001. At Societe Generale he served in various roles, including COO of Corporate Investment Banking Japan, President & CEO of Societe Generale Securities North Pacific Japan, President & CEO of Societe Generale Private Banking Japan Ltd. and Chief Country Officer, Societe Generale Group Japan. In 2013, he joined SMBC Trust Bank as Chairman and Director upon the acquisition by SMBC of the Societe Generale Trust Banking license. He has served as a Director of the Board at SMBC Trust Bank since its establishment.

From late 2014 until October 2021 he served as Natixis Senior Country Manager for Japan, President & Representative Director of Natixis Japan Securities Co., Ltd. and member of the Executive Committee of Natixis CIB Asia Pacific.

He is the Representative Director of Escapade Japan Co. Ltd. supporting financial institutions on governance and organizational matters.

Laurent studied linguistics in Belgium, Spain and the UK. He is a graduate of Institut Libre Marie Haps, Université Catholique de Louvain, Belgium.

“The global landscape for responsible investment”

Strategy Development and Management Bureau,

Financial Services Agency of Japan

Strategy Development and Management Bureau,

Financial Services Agency of Japan

Mr. Horimoto started his career at the Ministry of Finance, as well as serving as a Special Advisor for the International Bank for Reconstruction and Development (IBRD).

Throughout his career at JFSA, Mr. Horimoto has mainly been involved in the supervision and inspection of financial institutions. Mr. Horimoto was Deputy Director-General, Supervision Bureau, in charge of the supervision of Mega Banks among other large financial institutions from 2021 to June 2022, preceded by being Deputy Director-General, Strategy Development and Management Bureau, in charge of the inspection from 2019 to June 2021.

Mr. Horimoto has also been Counsellor of Cabinet Secretariat and Deputy Director-General of Cabinet Secretariat since 2014. Mr. Horimoto is currently Deputy Director-General of the New Form of Capitalism Realization Headquarters, Cabinet Secretariat.

Additionally, Mr. Horimoto worked as a senior manager at a private consulting firm for five years.

Mr. Horimoto holds B.B.A. from the University of Tokyo.

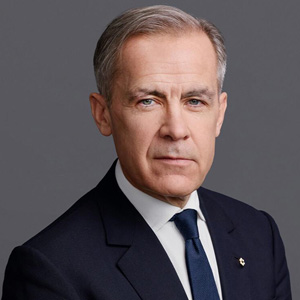

Mr. Carney is an economist and banker who served as the Governor of the Bank of England from 2013 to 2020, and prior to that as Governor of the Bank of Canada from 2008 until 2013. He was Chairman of the Financial Stability Board from 2011 to 2018. Prior to his governorships, Mr. Carney worked at Goldman Sachs as well as the Canadian Department of Finance.

He is a long-time and well-known advocate for sustainability, specifically with regard to the management and reduction of climate risks, and is currently the United Nations Special Envoy for Climate Action and Finance and Co-Chair for the Glasgow Finance Alliance for Net Zero.

He is also an external member of the Board of Stripe, a member of the Global Advisory Board of PIMCO, the Group of Thirty, Harvard University, Rideau Hall Foundation, Bilderberg, the Foundation Board of the World Economic Forum, the boards of Bloomberg Philanthropies, the Peterson Institute for International Economics the Hoffman Institute for Global Business and Society at INSEAD, Cultivo, as well as Senior counsellor of the MacroAdvisory Partners, Advisor of the Watershed, and Chair of Chatham House.

Mr. Carney holds doctorate and master’s degrees from Oxford University and a bachelor’s degree in Economics from Harvard University.

“Promoting Transition Finance”

After graduating from Keio University’s Faculty of Economics in 1987, Seo joined Ishikawajima-Harima Heavy Industries Co., now IHI, and mainly engaged in work related to personnel affairs/labor management, human resources development and organizational development. He set up an auto parts-making joint venture as a new business in Moscow in 2006 and stayed in the Russian capital as the JV’s president for six years. Seo became manager of the Planning & Control Department at IHI’s Global Marketing Headquarters in 2013, manager of the Corporate Business Development Division in 2017 and general manager of the Corporate Planning Division in 2018. He assumed his current posts in 2022. Seo has worked to solve social issues utilizing “the largest and only asset”–human resources–as the driving force and promoted appropriate corporate management with consideration for society and the environment while placing ESG at the center of his values.

Japan Credit Rating Agency, Ltd.

Japan Credit Rating Agency, Ltd.

Ms. Kajiwara joined Japan Credit Rating Agency, Ltd. in 2000. Until 2017, she was working as a sovereign analyst in charge of Latin America, East Europe and multinational banks. Since 2017, she is working as a head of sustainable finance evaluation. She is a committee member of MOE’s Green Finance WG, METI’s Transition Road Map WG, MITI’s WG for promoting ESG investment in the social aspects of Real Estates, etc..

May 8, 1963

Born

Apr. 1986

Joined Nippon Life Insurance Company

Mar. 2017

Executive Officer

Jul. 2018

Audit and Supervisory Board Member

Mar. 2021

Senior Audit and Supervisory Board Member

Jul. 2022

Managing Executive Officer (present)

“The latest global trends in Impact Management for Investments

ー Expectations and the role of Japan”

“Impact Investing Goes to ‘How’”

In 2009, Mr. Takada became the first staff of the newly created National Policy Unit and worked in the Prime Minister’s Office and the Cabinet Secretariat as an architect of the new public finance framework and as a private advisor to the Prime Minister. After having held senior positions in the Finance Minister’s Secretariat responsible for overall coordination and public relations of the Ministry, he was seconded to the OECD, Paris, where he worked as a Senior Policy Analyst at the Green Finance and Investment team, Environment Directorate, from 2015 to 2018.

After his return to Tokyo, Mr. Takada worked at the IR Promotion Office, Cabinet Secretariat (2018-20), the Civil Service Remuneration and Benefits Division, Budget Bureau, Ministry of Finance (2020- March 2021), and the newly established Climate Change Office at the Cabinet Secretariat (March – July 2021). From July 2021, he works as the Director for Budget responsible for local government finance at the Budget Bureau, Ministry of Finance. From 2022, as a concurrent post, Mr. Takada also works as the Director for Strategy Development at the Financial Services Agency, responsible for financial market policies including promotion of international financial centres and sustainable finance.

Alongside his official jobs, in his private capacity, Mr. Takada launched the Green Finance Network Japan (GFNJ) in 2018 as its Secretary General. The GFNJ is an informal network that brings together key players on green finance in Japan from both public and private sectors and provides a platform for collaborating with international stakeholders.

Mr. Takada received a Bachelor degree in Law (University of Tokyo), a Master degree in Law (Cambridge University) and an MBA (Imperial College London).

Founder and Chairman, Commons Asset Management

Founder and CEO, & Capital, Inc.

Senior Advisor, Brunswick Group

Founder and Chairman, Commons Asset Management

Founder and CEO, & Capital, Inc.

Senior Advisor, Brunswick Group

He has extensive market experience at JP Morgan and Goldman Sachs as well as Moore Capital, a global macro hedge fund, where he was the representative managing director of the Tokyo Office.

He is also trustee of Keizai Doyukai (Japan Association of Corporate Executives) and chairman of Global South Africa Committee, advisor to the Office of the President at the University of Tokyo, steering committee member of UNDP SDG Impact, and member of the Council for New Form of Capitalism, established by PM Kishida.

In 2022, he was named as board member of the newly founded International Foundation for Valuing Impact, as special advisor to the ISSB(International Sustainability Standards Boards) chair. In 2023, he founded &Capital, Inc., an impact fund management company for Africa.

He is a published author and writes frequently for magazines, journals, and internet media.

He also publishes and hosts of a podcast, Made With Japan https://madewithjapan.net/ He was educated in the United States from second grade elementary through college (University of Texas, BS Chemical Engineering, 1983), and then returned again for graduate school (University of California Los Angeles, MBA, 1987).

Sumitomo Mitsui Trust Bank

Sumitomo Mitsui Trust Bank

Ms. Huang setup the impact team in 2017, currently managing 2 impact investment funds, “Childcare Support Fund” and “HATARAKU (WORK) Fund” as investment committee member. The “Childcare Support Fund” was the first impact investment fund for Japanese bank group and she has been awarded as “Woman of the Year 2019” by Nikkei Woman for these activities.

Ms. Huang is also the member of Japan National Advisory Board of GSG(Global Steering Group for Impact Investment), board member of CFA (Chartered Financial Analyst) Society Japan, visiting researcher of Center for Social Investment, Tama University etc.

Ms. Huang received B.A. in Finance from Shanghai University of Finance and Economics, and MBA from Kobe University, Japan. She is also a CFA Charter holder, and AICPA of Delaware, USA.

Social Innovation and Investment Foundation (SIIF)

Social Innovation and Investment Foundation (SIIF)

sustainacraft, Inc.

sustainacraft, Inc.

Promoted a data analytical business focused on machine learning in the Business Analytics Department in SAP Japan (his previous job) from 2016.

Has participated in SENSYN ROBOTICS from October 2018.

Tsubame BHB Co., Ltd.

Tsubame BHB Co., Ltd.

Tsubame BHB Co., Ltd.

He joined Tsubame BHB in November 2021, has a record of promoting equity finance of about 4 billion Japanese Yen.

“Tokyo as an Asian Hub for Sustainable Finance”

“The Path to Becoming an International Financial Center”

She has co-authored books including “Financial Literacy for Me,” “Introduction to Community Finance x SDGs for Local Officials,” “SDGs Textbook for Business Professionals,” and “ESG Handbook for Investors and Companies”(all in Japanese). In addition, she has conducted lectures and writing activities.

He is an expert in such fields as urban policy, international urban competitiveness, crisis management, and telework, and has published numerous works about Tokyo and large metropolises. Some of his selected published works include A New Evolutionary Theory for Tokyo (2019), City’s Écriture (2018), Creative Tokyo Reborn (2017), Tokyo’s Unipolar Concentration Will Save Japan (2015), Tokyo 2025: Urban Strategies for the Post Olympic Era (2015), Lesson from Japanese Disaster (2011), and Building Japan’s Future (2009).

In addition to working with the Japanese and Tokyo Metropolitan Governments, he has also served several public and private institutions in roles such as President, Chairman, and policy committee member. Presently, he is Chairman of the Japan Telework Society as well as the Japan Emergency Management Association. He graduated from Waseda University with a Bachelor of Architecture and a Master of Urban Planning, and further studied at the University of Waterloo where he was granted a Ph.D. in urban and regional planning. He was born in 1947, in Tokyo, and is a first-class registered architect in Japan.

During his time at BoJ, he served as Head of Financial Markets Facilitation Division,

Head of Foreign Exchange Division, and Associate Director General for International Finance, to mention but a few. In 2022, he joined FinCity.Tokyo as head of policy research. He holds an MA of Economics from Yale University.

Board Director and Group Chief Sustainability Officer, Future Corporation

Board Director and Group Chief Sustainability Officer, Future Corporation

Development Bank of Japan, Inc.

Development Bank of Japan, Inc.

Ms.Harada has a long and dynamic career in development banking, including cross-border corporate and infrastructure finance in energy, transportation, and PPP/PFI projects worldwide, with a special focus on the renewable energy sector.

She has also been involved in Japanese government policy-making for energy by sitting on several key government committees as a specialist in infrastructure and energy finance. Focusing on areas include power cost, offshore wind power, battery and hydrogen.

She previously led DBJ’s Structured Finance Department and was a Deputy CEO of DBJ Singapore Ltd., a DBJ subsidiary covering corporate and structured finance deals in Southeast Asia and the Pacific. Her experience also includes a secondment to the Infrastructure and Natural Resource Department (East Asia) of the International Finance Corporation (IFC) of the World Bank as a Senior Investment Officer.

Ms. Harada holds a BA in Economics from The University of Tokyo.

July 2016 Elected Governor of Tokyo

October 2011 Director, Committee on Budget, House of Representatives

September 2010 Chairperson, General Council, Liberal Democratic Party

July 2007 Minister of Defense

September 2006 Special Advisor to the Prime Minister for National Security Affairs

September 2004 Minister of the Environment and Minister of State for Okinawa and Northern Territories Affairs

September 2003 Minister of the Environment

July 1993 Member of the House of Representatives

July 1992 Member of the House of Councillors

| Organizer | The Organization of Global Financial City Tokyo |

|---|---|

| Supporting Organizations |

Principles for Responsible Investment (PRI), Financial Services Agency,Japanese Bankers Association,Investment Trusts Association,Japan Securities Dealers Association,Japan Investment Advisers Association,Japan Society of Securities Analysts,CFA Society Japan,Japan Exchange Group, Inc.,Tokyo Stock Exchange, Inc.,The Alternative Investment Management Association (AIMA),Japan Investment Asset Managers Association(JIAM) |

| Date & Time | Friday, October 6, 2023, 13:00-18:00 (JST) *Networking opportunities will be offered at the venue after the forum. |

| Event format | Hybrid (Both in-person & online participation) *Applications for on-site participation are accepted on a first-come, first-served basis. *Online participation will be accepted until the end of the event. *Simultaneous distribution in English and Japanese will be available. |

| Entry fee | Free for both in-person and online participation (Pre-registration required) |

| Venue | KABUTO ONE Hall & Conference (7-1 Nihonbashi Kabuto-cho, Chuo-ku, Tokyo) |

| Access to the venue | Venue website https://kabutoone.tokyo/#access |

Financial Market Information Div,

Jiji Press

E-mail:mk-seminar@jiji.co.jp